.avif)

The Ministry of Defence (MoD) updated its commercial pipeline on the 30th April 2024 to give suppliers a forward look into upcoming procurement activity for all contracts valued over £2m over the next 18 months.

Overall, 14 different MoD departments have published 443 upcoming contracts with a total value of more than £37b.

Upcoming opportunities

Valued at a total £37b opportunity for suppliers

With 37.2% headed towards SME companies

For your convenience, this report outlines key learnings from the commercial pipeline update to help you:

To identify specific upcoming MoD opportunities for your business, access the 2024/25 commercial pipeline document here.

The MoD is responsible for 14 different departments, each of which governs a different defence area.

Below, we visualise the sum of pipeline funding allocated to each department to help you focus your sales efforts on the most significant opportunities within this account.

The above table clearly shows that DE&S and DIO represent the highest areas of investment for 2024/2025. However, these opportunities might not be relevant for smaller businesses.

Digging into the contracts behind the data, DE&S and DIO plan to procure only 21% of their upcoming contracts from SMEs, with most of these contracts suited for construction, munitions, and vehicle manufacturers. Large niche suppliers with historical relationships will be preferred within these departments.

For SMEs, we recommend you deprioritise DE&S and DIO. Instead, target departments like Defence Digital (DD), which primarily procures software, or the Navy which have declared 100% of their contracts being suitable for SMEs.

The MoD commercial pipeline update reveals the planned route to market for every contract valued above £2m. Below we've listed frameworks that the MoD expect to procure future contracts through published in the commercial pipeline update.

Understanding what frameworks MoD procures through allows you to effectively plan your go-to-market strategy. With CCS frameworks leading the way, it's essential suppliers closely track frameworks emerging from this organisation.

For active frameworks you are not yet listed on, we recommend suppliers track key dates for upcoming renewals and identify potential partner suppliers already listed to maximise your chances of winning a contract.

Successful suppliers use Stotles' new Frameworks Intelligence feature on their target accounts to bid on the most promising opportunities.

Now you know which departments the MoD is investing in and what frameworks they are using, the next step is to identify relevant contracts you can target.

Containing all future opportunities over £2m, we've highlighted the top 5 digital contracts to demonstrate how you can use the commercial pipeline to identify potential opportunities in your industry.

For suppliers that are outside of the digital industry, take a look at the MoD commercial pipeline update to find upcoming opportunities that suit your business.

The MoD commercial pipeline update only provides visibility into contracts with an expected value above £2m. For contracts under £2m, the MoD is not required to publish a prior pipeline contract.

To anticipate upcoming opportunities below this threshold, suppliers typically use expiring contracts to indicate contracts to potentially target renewals.

“Expiring contracts allow us to forecast what we expect to emerge from a particular buyer or service.”

Using the Stotles platform, customers can easily identify relevant upcoming expiries to target based on their industry and business signals. To demonstrate the opportunities involved, we've highlighted below 5 upcoming expiries for IT & Software industry suppliers to consider.

Using the Stotles platform, our customers are easily able to identify upcoming contract expiries to target across the public sector. Ready to find your next big win?

Successful defence suppliers pre-engage with procurement decision-makers over renewing contracts. This allows you to showcase your product, build trust across the whole buyer organisation, and gather unpublished information about the opportunity.

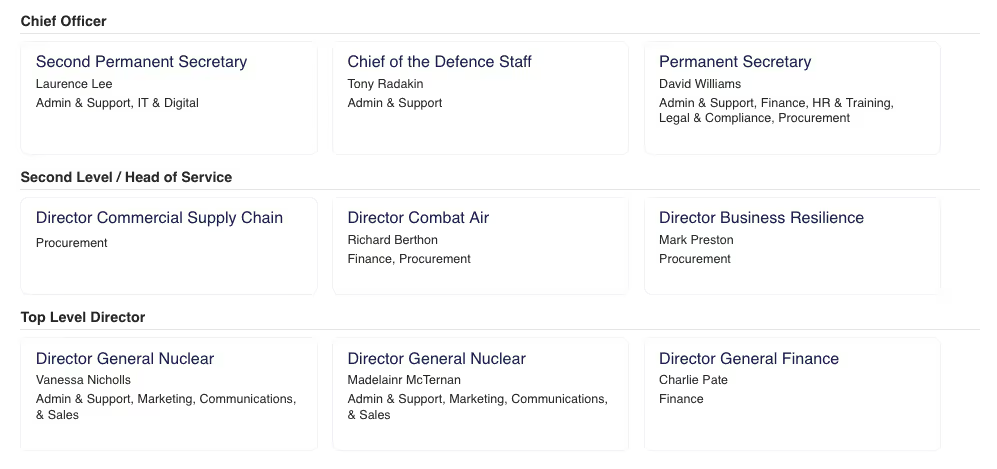

We have highlighted senior procurement decision-makers in the MoD below to demonstrate how you can use Stotles to identify relevant decision-makers.

To explore the contact finder feature further and find a list of the most important decision makers, get in touch with a member of our team.

The MoD commercial pipeline update allows us to understand routes to market across the 14 departments and the essential frameworks to be on to win more contracts.

This report should enable your sales teams to efficiently identify and qualify the most promising opportunities whilst using the Stotles platform to pinpoint upcoming contract renewals and what key decision makers to engage with.

This report was designed using the MoD pipeline update in tandem with Stotles data to provide suppliers with a tool to do better business with the MoD.

Enter your details to download this report.

Enter your details to download this report.