.avif)

As we approach the end of the 2024/25 financial year, local authorities operating under a 'use it or lose it' budget model face growing pressure to expedite essential digital service procurements before April, so suppliers must be ready to seize these critical opportunities.

This Stotles report was designed to help sales teams win more back-office public sector tenders.

Read ahead to:

Below is a graph outlining the value in upcoming opportunities for each of the back office industries covered in this report. This helps you grasp the scope of these opportunities within the UK public sector’s local authorities.

For each of these sub-industries, we will outline the most active buyers, your key competitors and upcoming opportunities for you to add to your sales pipeline.

This type of TAM analysis can be replicated for any industry across the entire public sector. Sign up for free to learn more.

CRM and case management systems help local authorities manage citizen interactions and streamline case handling. They are crucial for operational efficiency and are usually up for re-procurement, making them essential for targets for efficient public sector sales teams.

To help you identify sources of relevant opportunities in the future, we've highlighted the top buyers of CRM and case management software by both value and volume over the last five years.

Using this data, you can target local authorities that are likely sources of future procurement opportunities, track upcoming contract expiries and engage with key decision-makers to stay ahead of your competition.

Deep dive into Kent County Council through the Stotles platform and understand what software has been procured - including previous contract values, incumbent suppliers, and contract expiry dates.

Below, we’ve found the top 10 suppliers of CRM and Case management software services to local authorities.

For suppliers looking to serve this sector, this top 10 list may well represent your most significant competitors.

Knowing your competitors helps you strategically position your bids. Top suppliers avoid targeting buyers with long-standing relationships where re-procurement is likely secured by incumbents. Instead, focus on buyers where your offering can stand out and challenge existing suppliers.

Deep dive into Civica through the Stotles platform and understand what contracts Civica have been awarded, when the contracts are due to expire, and their top government clients.

In this section, we spotlight contracts issued by local authorities that are coming up for expiration in the next 12 months. Suppliers use this type of data to pre-emptively target opportunities that are likely to be re-procured.

By focusing on these expiring contracts, you can position your bids early and engage decision-makers before the competition.

Click on the relevant contract for your company to learn more.

Start engaging today with Stotles, and secure these opportunities.

Enterprise Resource Planning (ERP) and workflow systems are essential for local authorities to manage resources, streamline processes, and maintain operational efficiency. Given their importance, these systems are frequently re-procured, presenting ongoing opportunities for suppliers.

To assist in identifying future opportunities, we’ve highlighted the top buyers of ERP and workflow systems by value and volume over the past five years.

This data shows which local authorities are likely to re-procure soon, enabling you to track upcoming expirations and engage decision-makers early.

It’s important to note that ERP systems tend to be procured by larger authorities. Suppliers should focus on these high-value buyers to maximise their chances of success.

Deep dive into Cheshire East Council through the Stotles platform and understand what software has been procured, including previous contract values, incumbent suppliers, and contract expiry dates.

Here are the top 10 suppliers of ERP and workflow systems to local authorities.

Understanding the competitive landscape is crucial. Buyers with long-standing supplier relationships may be locked into existing deals, so you should target authorities where you can disrupt incumbents with a tailored and innovative offering.

Deep dive into Unit4 through the Stotles platform and understand what contracts Unit4 have been awarded, when the contracts are due to expire, and their top government clients.

We’ve identified several contracts expiring in the next 12 months. Use this data to target these re-procurement opportunities and engage decision-makers before the competition.

Click on the relevant contract for your company to learn more.

Take advantage of these opportunities by positioning your bids early to maximise your chances of success.

HR and finance systems are critical tools that local authorities rely on to manage staff, payroll, budgeting, and financial reporting. These systems underpin smooth operations, making them essential for day-to-day functioning and frequently re-procured, offering consistent opportunities for suppliers to engage.

To help you identify key opportunities, we’ve highlighted the top buyers of HR and finance systems by both value and volume over the past five years.

With this data, you can pinpoint which local authorities are likely to re-procure soon, track upcoming contract expiries, and engage with decision-makers to stay ahead of your competition.

Deep dive into Bristol City Council through the Stotles platform and understand what software has been procured - including previous contract values, incumbent suppliers, and contract expiry dates.

Below are the top 10 suppliers of HR and finance systems to local authorities.

Knowing your competitors in this space is essential for strategically positioning your bids. Buyers with long-standing relationships with certain suppliers may be harder to penetrate, so it’s crucial to focus on buyers where your offering has the potential to disrupt incumbents and deliver value.

Deep dive into Capita Business Services through the Stotles platform and understand what contracts Capita Business Services have been awarded, when the contracts are due to expire, and their top government clients.

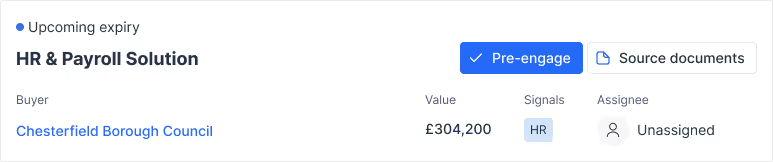

In this section, we spotlight HR and finance system contracts that are set to expire in the next 12 months. Suppliers can use this data to target likely re-procurement opportunities and engage decision-makers before the competition.

Click on the relevant contract for your company to learn more.

.avif)

Start acting on these opportunities now to secure your place in upcoming procurement cycles.

Print and mail systems, though often overlooked, are vital for local authorities to manage communications, invoicing, and document distribution efficiently. These services remain integral to many operations, ensuring compliance and keeping essential services running smoothly. As a result, they are regularly re-procured, offering steady opportunities for suppliers in this sector.

We’ve compiled the top buyers of print and mail systems over the past five years, both by procurement value and volume, to help you target high-potential opportunities.

As we can see, TFL is the strongest buyer in terms of value, but the data reveals that the London Borough of Hackney has had the highest volume of Print and Mail systems opportunities come to market in the last five years.

This data enables you to zero in on local authorities with a history of significant procurement in this area, allowing you to track expiring contracts and position yourself early in the re-procurement process.

Deep dive into Gloucestershire County Council through the Stotles platform and understand what software has been procured - including previous contract values, incumbent suppliers, and contract expiry dates.

Here are the top 10 suppliers currently serving local authorities with print and mail systems:

To effectively compete in this market, it’s important to understand where key suppliers have established relationships that may be hard to break. Focus on buyers where there is room to challenge incumbents and where your offering can deliver greater efficiency or cost savings.

Deep dive into Canon through the Stotles platform and understand what contracts Canon have been awarded, when the contracts are due to expire, and their top government clients.

In this section, we spotlight print and mail system contracts due for expiration in the next year. This data allows suppliers to strategically approach buyers with upcoming re-procurement needs, giving you the chance to position your bid early.

Click on the relevant contract to your company to learn more.

To replicate this analysis in any vertical with any government authority, sign up for free today.

The insights from this report provide a solid foundation to refine your sales strategy, identify high-potential buyers and position yourself ahead of the competition.

Here’s how to get started:

Enter your details to download this report.

Enter your details to download this report.